Amazon Law and tax obligations in construction and consulting companies, Huanuco

DOI:

https://doi.org/10.37711/rcie.2021.1.1.4Keywords:

tax exoneration, income tax, taxation, legislation, Amazon law, tax exemptionAbstract

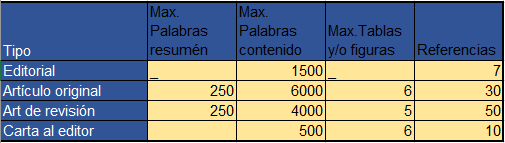

Objective.To determine the influence between the Amazon Law and tax obligations in construction and consulting companies in the province of Huánuco. Methods. The research used was applied, quantitative approach, correlational descriptive level or scope, and non-experimental design of descriptive transectional type.The population consisted of companies engaged in the construction and consulting activity; the sample was non-probabilistic by convenience. The survey and the interview were used as techniques. The data collection instruments used were the questionnaire and the interview guide, applied to the managers and administrators of the construction and consulting companies. Results. According to the research carried out, sales in the Amazon significantly influence the tax obligations on construction companies and consultants, since more than half of the respondents make their IGV. payments in full. The reasons were established to have no problem with SUNAT. Conclusions. The relationship between the independent variable and the dependent variable is inversely null, so a relational value of -0.068 was obtained, obtaining a negative correlation, thus rejecting the general hypothesis, i.e., inversely proportional. This means that the higher the tax obligations, the lower the perception of the Amazon Law on construction and consulting companies in the province of Huánuco

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Innovación Empresarial

This work is licensed under a Creative Commons Attribution 4.0 International License.

a. Los autores conservan los derechos de propiedad intelectual (copyright) de las obras publicadas, cediendole a la revista el derecho de primera publicación.

b. Los autores retienen sus derechos de marca y patente, y también sobre cualquier proceso o procedimiento descrito en el artículo.

c. Los autores retienen el derecho de compartir, copiar, distribuir, ejecutar y comunicar públicamente el artículo publicado en la revista Innovación Empresarial (por ejemplo, colocarlo en un repositorio institucional o publicarlo en un libro), con un reconocimiento de su publicación inicial en la revista Innovación Empresarial.

d. Los autores retienen el derecho a hacer una posterior publicación de su trabajo, de utilizar el artículo o cualquier parte de aquel (por ejemplo: una compilación de sus trabajos, notas para conferencias, tesis, o para un libro), siempre que indiquen la fuente de publicación (autores del trabajo, revista, volumen, número y fecha).