Tax evasion and tax collection

DOI:

https://doi.org/10.37711/rcie.2021.1.1.6Keywords:

taxation, income tax, public expenditure, StateAbstract

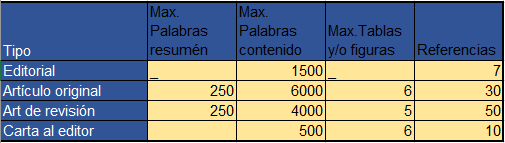

Objective. The objective of the research was to contribute to the diagnosis of tax evasion in the hotel business in the district of Amarilis and its impact on tax revenues. Methods. The research approach was quantitative, applied type and correlational descriptive level. Results. The results obtained indicate a moderate positive correlation level (0.366) between the study variables. Conclusions. It is concluded that tax evasion is related to tax collection in hotel companies in the district of Amarilis, Huánuco.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Innovación Empresarial

This work is licensed under a Creative Commons Attribution 4.0 International License.

a. Los autores conservan los derechos de propiedad intelectual (copyright) de las obras publicadas, cediendole a la revista el derecho de primera publicación.

b. Los autores retienen sus derechos de marca y patente, y también sobre cualquier proceso o procedimiento descrito en el artículo.

c. Los autores retienen el derecho de compartir, copiar, distribuir, ejecutar y comunicar públicamente el artículo publicado en la revista Innovación Empresarial (por ejemplo, colocarlo en un repositorio institucional o publicarlo en un libro), con un reconocimiento de su publicación inicial en la revista Innovación Empresarial.

d. Los autores retienen el derecho a hacer una posterior publicación de su trabajo, de utilizar el artículo o cualquier parte de aquel (por ejemplo: una compilación de sus trabajos, notas para conferencias, tesis, o para un libro), siempre que indiquen la fuente de publicación (autores del trabajo, revista, volumen, número y fecha).